In the last 18 months, Latin America has become the fastest-growing region for mobile banking attacks powered by Remote Access Trojans (RATs). These sophisticated malware variants give cybercriminals full, real-time control of victims' smartphones—from reading SMS one-time passwords to initiating unauthorized transfers within legitimate banking apps.

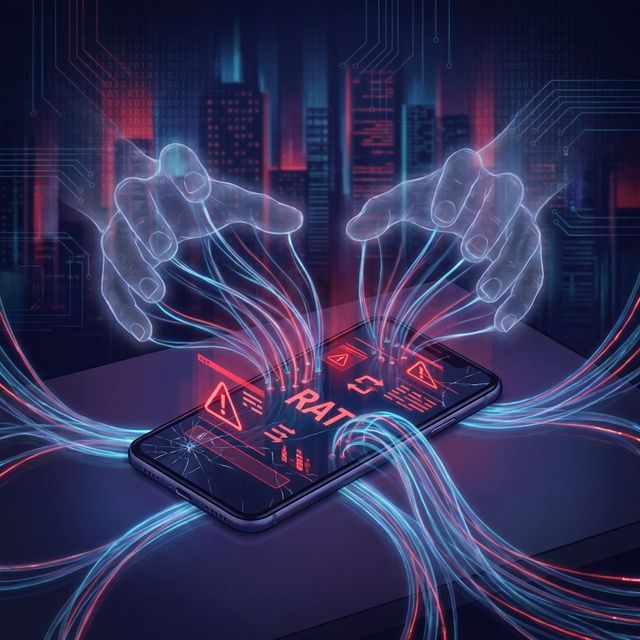

What Is a RAT and Why Should Financial Institutions Care?

A Remote Access Trojan is a type of malware that, once installed on a device, creates a hidden backdoor that allows an attacker to remotely control the device as if they were holding it in their hands. Unlike traditional phishing—which captures credentials at a single moment—RATs provide persistent, ongoing access to the victim's device.

For financial institutions, this means that even the most robust two-factor authentication (2FA) system can be rendered useless: the attacker can intercept SMS codes, read push notifications, and even initiate transactions directly from the victim's banking app while it's already authenticated.

The Anatomy of a RAT Attack in Latin America

Security researchers have documented a clear attack pattern across the region:

- Social engineering bait: Victims receive messages—often via WhatsApp, SMS, or social media—posing as government tax agencies, package delivery services, or banking institutions. In Mexico, attackers frequently impersonate the SAT (Tax Administration Service); in Colombia, DIAN; and in Brazil, Receita Federal.

- Malicious APK installation: The victim is tricked into downloading an app that appears legitimate but contains the RAT payload. These apps request broad permissions upon installation—accessibility services, screen overlay, SMS reading—all of which are critical for the attack to succeed.

- Silent device takeover: Once active, the RAT allows the operator to monitor all activity in real time. They wait until the victim opens their banking app, then either take control of the session directly or capture credentials and 2FA tokens for later use.

- Fraudulent transactions: Transfers are initiated from the victim's own device and IP address, making them extremely difficult to flag as fraudulent through traditional rule-based systems.

Why Latin America Is Especially Vulnerable

Several factors make the region a prime target:

- High Android market share: Over 85% of smartphones in Latin America run Android, and a significant portion operate on older versions that don't receive regular security patches. This creates an enormous attack surface for APK-based malware.

- Sideloading culture: In many countries, users are accustomed to installing apps from outside official stores—whether to access modified apps or services not available in their region—normalizing the installation of unknown APK files.

- Rapid mobile banking adoption: The post-pandemic digital banking boom has brought millions of users online who lack cybersecurity awareness. Neobanks and fintechs have expanded access significantly, but security education hasn't kept pace.

- Cross-border criminal networks: RAT-as-a-Service (RaaS) platforms are readily available on cybercrime forums, with operators often based in different countries than their victims, complicating law enforcement efforts.

Real-World Impact: The Numbers

According to industry reports from 2025:

- Organizations in Latin America experienced an average of 3,065 cyberattacks per week, a 26% year-over-year increase.

- Over 52,000 mobile banking Trojan installation packages were discovered in Q3 2025 alone.

- Banking fraud losses attributed to mobile device compromise grew by 40% year-over-year across the region's top five economies.

How Financial Institutions Can Defend Against RAT Attacks

Traditional perimeter security is insufficient. Institutions need to adopt a device-centric, behavioral approach to fraud prevention:

- Real-time device integrity checks: Detect the presence of accessibility service abuse, screen overlay attacks, and known RAT signatures before allowing sensitive transactions.

- Behavioral biometrics: Analyze typing patterns, touch pressure, swipe velocity, and device handling to detect when a transaction is being performed by a remote operator rather than the legitimate user.

- Session anomaly detection: Flag sessions where device behavior suggests remote control—such as programmatic taps, unusual input timing, or simultaneous screen recording.

- Transaction risk scoring: Combine device signals, behavioral patterns, and contextual data (location, time, amount) to generate real-time risk scores for each transaction.

- Continuous authentication: Move beyond login-time verification to continuous identity assurance throughout the entire user session.

Conclusion

RAT malware represents one of the most dangerous threats to mobile banking security in Latin America today. As the region continues its rapid digital transformation, financial institutions must invest in advanced, multi-layered fraud prevention that can detect and respond to these attacks in real time—protecting both the institution and its customers from this growing threat.

The stakes are clear: every unprotected session is an opportunity for attackers. The financial sector must act now to close this gap before losses escalate further.